Today I attempt to list down the categories and dimension which could be input into a customer segmentation model. This list, though comprehensive, is in no way exhaustive. But I don't think this is an area of concern since not many companies could fill in a majority of these dimensions with customer data.

I have categorised the dimension into classes. For some dimension, I have also stated some sample values. I am not attempting to explain the dimension since a quick google on the meaning of the dimension name should give enough insight into its explanation and the likely values the dimension with contain in the data set.

1. Class: Geographic

1.a: Region

1.b: City size

1.c: Density of area

1.d: Climate

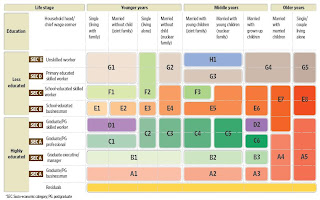

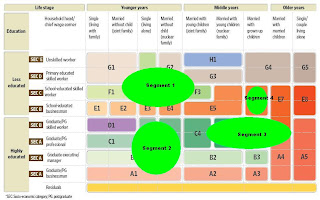

2. Class: Demographic

2.a: Age

2.b: Sex

2.c: Marital status

2.d: Income

2.e: Education

2.f: Occupation

3. Class: Psychological

3.a: Needs-motivation

sample values: shelter, safety, security, affection, sense of self worth

3.b: Personality

sample values: extroverts, novelty seeker, aggressives, low dogmatics

3.c: Perception

sample values: low-risk, moderate-risk, high-risk

3.d: Learning involvement

3.e: Attitudes

4. Class: Pscychographic

4.a: Lifestyle

sample values: economy-minded, couch potatoes, outdoor enthusiasts, status seekers

5. Class: Sociocultural

5.a: Cultures

sample values: Bangla, Egyptian, Indian, Nepali, Pakistani

5.b: Religion

5.c: Subcultures

sample values: African, American, Asian, Hispanic

5.d: Social Class

5.e: Family life cycle

sample values: bachelors, young married, full nesters, empty nesters

6. Class: Use related

6.a: Usage rate

sample values: heavy users, medium users, light users, non users

6.b: Awareness status

sample values: unaware, aware, interested, enthusiastic

6.c: Brand loyalty

sample values: none, some, strong

7. Class: Use situation

7.a: Time

sample values: leisure, work, rush, morning, night

7.b: Objective

sample values: personal, gift, snack, fun, achievement

7.c: Location

sample values: home, work, friend's home, in-store

7.d: Person

sample values: self, family members, friends, supervisor, manager, peers

8. Class: Benefit

sample values: convenience, social accpetance, long lasting, economy, value-for-money

9. Class: Hybrid segmentation: implies using output of other segmentation model as an input to the current segmentation exercise.

Contact me at michaeldsilva@gmail.com if you want to discuss further on conducting a segmentation exercise for your customer base.